111111111111111111111

Apple Instant

Welcome to Apple Instant Blogger, you can get more useful, professional and interesting tips, news, and guidance about your iPhone/iPad/iPod and Android phone from our articles.

Thursday, November 26, 2020

Thursday, November 29, 2018

Bitmain 7nm S15 Bitcoin Cloud Mining Contract in Stock

OXBTC launches a new Bitcoin cloud mining contract BTC-S15 with higher profits and lower electricity fee. The contract runs Antminer 7nm S15 with high profits. 5 years contract period owns continuous and stable profits. The electricity fee is $0.1096/THS/Day, drops 36%.

Three Advantages of BTC-S15:

1. Run Antminer S15 with Higher Profits

BTC-S15 hashrate contract runs 7nm miner: Antminer S15. Compared with S9, S15 owns 70W/THs of actual efficiency and 28TH/s of hashrate with higher performance and lower energy consumption.

2. 5 Years Mining Period with Continuous and Stable Profits

After you purchase BTC-S15 contract, your mining services will run for 5 years period - even in cases where your daily mining reward falls below the Maintenance Fees. This way, your daily income will be more continuous and stable.

3. Electricity Fee: $0.1096/THS/Day, Drops 36%

Based on powerful performance of S15, electricity fee of BTC-S15 contract drops to $0.1096/THS/day. Compared with S9 contract, new contract will save 36% electricity fee for you. The maintenance fees will be far lower than other cloud hashrate products in the market.

Contract Details:

• Price: $60.90/THS

• Management Fee: 5%

• Electricity Fee: $0.1096/THS/天(Drops 36%)

• Efficiency: 70W/T

• Contract Peroid: 5 Years

• Inventory: 1400THS

• Delivery Time: Next day after purchase

OXBTC has been providing reliable cloud mining services for global 600,000 customers for 4 years! And we will continue to deliver even better cloud mining products and better customer services in the future.

Get first-hand information from:

Telegram: https://t.me/oxbtcofficial

Facebook: OXBTC (http://www.facebook.com/oxbitcoin/)

Email: support@oxbtc.com

Website: www.oxbtc.com

Monday, November 26, 2018

OXBTC Set Cloud Minig Innovation in Bear Market

Recently, the price of bitcoin has continued to fall. As of the current time, the price of bitcoin was 3,642 US dollars on November 27, 2018. The price of bitcoin plunged 81% from the highest point of 19,886 US dollars last year, and the market value evaporated by 263 billion US dollars. For all new users of the 2018, they experienced several consecutive plunge and suffered heavy losses. For the users of mining, it is even more difficult.

It is reported that a number of cloud mining platforms have been declared closed because the Bitcoin cloud mining contract has been unable to pay electricity and management fees for ten consecutive days. In response to this situation, OXBTC as the old-fashioned cloud mining platform established in China in 2014, launched a policy of extending the contract period, extending the observation period of contract closure from 10 days to 90 days. If the contract revenue is higher than the electricity fees on any day within 90 days, the contract can be resumed and the cloud mining contract is still valid. The risk caused by the large fluctuations in the currency price is greatly reduced.

The contract period of a general cloud mining contract is permanent. As we all know, the normal life of a mining machine is generally about 2 years, and the physical life will end. However, another risk is not ruled out, that is, the currency price has plummeted. Therefore, many cloud mining platforms will have an additional conditional cloud mining contract for 10 consecutive days of actual income insufficient to offset the electricity bill, then the contract is terminated.

OXBTC knows the risk of currency price fluctuations in the near future. In order to protect the rights and interests of users, it has created a 90-day observation period: when the mining revenue is less than the electricity expenses, the contract will suspend mining; when this situation occurs continuously for 90 days at the time, the contract will be terminated. However, if the mining revenue is higher than the electricity bill within 90 days, the contract is still valid.

The world moves and on, 90 days is enough for the market to give a direction, and users have time to make adjustments and decisions. As someone said, energy should not be concentrated on predictions. No one can predict 100%, but focus on reaction. That is what happens, how do I react. That is the strategy. Develop a strategy and then execute it. If the strategy is wrong, modify the strategy.

In this round of bear market, there are many platforms disappeared and shutting down. First, the ICO project side disappeared, and the famous star project consumer chain (CDC) is the most famous one. The founder Yang Ning is a well-known angel investor in the Internet industry. After selling in peak price, he confessed his fault but told that cryptocurrency was not reliable, and treat the investors are mentally retarded. Then there is the exchange disappeared, take the innocent investors’ Money away. There are very few platforms that can really stay and do things. After this round of bear market, the companies that still survive will surely become the stars of the next round of bull market.

In 1926, the Russian economist Nikolai Kondratiev, after analyzing a large number of statistics of Britain, France, the United States, Germany and the world economy, discovered a long period of 50-60 years in the developed commodity economy, and that is called super cycles. The super cycles is divided into four phases, rising, prospering, recession, and depression. However, in the cryptocurrency circle, this time period may be shorter. After the depression period, will spring be far behind?

Is It the Right Time to Start Bitcoin Mining in Bear Market?

Up to now, it reached the highest bitcoin price of 20,000 US dollars last year, the entire cryptocurrency market has been intermittently falling for nearly 10 months, we continue to see a lot of project, media, exchanges, etc. faded out one by one. The once-rich cryptocurrency ecology has long been deplorable: the project has long been unable to launch an ICO, the trading volume of the exchange is bleak, and only some of the miners who remain are still looking at their own profits.

Once mining has once again become the final value support for the entire industry, it has become the final leg that can prove the existence of the industry; for any investor who still wants to continue to make money in the cryptocurrency, mining should not be ignored for current investment potential. And as the market has entered the bottom area, the investment dividend for mining has once again become clear.

The best way to invest in Bitcoin: fixed investment or mining

There are two main types in Bitcoin investments:

1. Long-term investors:

People who agree with the long-term value of Bitcoin are generally based on fixed investment (fixed investment refers to investing in a fixed period, such as buying a certain amount of bitcoin per month). Fixed investment can spread the risk of investment on average, and is extremely suitable for investment products such as Bitcoin and Ethereum.

2. Short-term investors:

For investors with a certain level of trade, it is necessary to have a higher level to ensure stable profitability.

3. Ordinary investors:

Bitcoin mining, mining has a large threshold, involving many factors, so many investors will choose to invest in mining by purchasing cloud computing (cloud mining) products.

So for investors, they will think about a question: which one can earn higher profits? Fixed investment of buying bitcoin or investment of mining?

The general conclusion is that when the price of the currency is constant, there is no difference between mining and fixed investment; when the price of the currency rises steadily, the fixed investment is better than mining; when the price of the currency rises, the mining is better than the fixed investment. The theory is the same, but in the actual investment behavior, although the fixed investment is stable, but the investors generally have problems that are difficult to implement continuously: 1. Lack of time and energy to execute the fixed investment; 2. Because of the aversion to loss, people always want to wait for lower price, which has led to the inability to implement the fixed investment strategy; 3. In the market fluctuations, it leads to greater losses in the short-term speculation . But Mining, investment quit is more troublesome, like a mandatory fixed investment method, often can obtain more sustained and stable income. It is for this reason that we often see that a large number of large-capital holders are mining origins. Therefore, for retail investors, if they can allocate fixed investment and mining investment into their own portfolios, the relative risks are far lower than purely buying bitcoins.

How retail investors participate in mining?

In recent years, as a low-threshold mining investment, cloud mining has become a common action for more and more cryptocurrency investors; For cloud mining platform, Genesis-mining and OXBTC are recommend as old brand platforms with more than one million users.

In essence, cloud mining is a mining investment tool that splits the mining rights of the mining machine. The user does not need to purchase the whole machine, and does not need to operate the mining machine, completely eliminating the capital and technical threshold for the general user to invest in mining. In terms of revenue, because the cloud mining saves the troubles of mining machine operation and maintenance, although the price is slightly higher than that of the mining machine, the income is more stable (the cloud mining platform generally distributes the proceeds according to the theoretical value. It avoids the loss of revenue caused by faults such as the drop of the mining machine).

The key to investing in cloud computing power is:

1. Choose a trusted platform to avoid the risk of platform disappeared after purchase; it is generally recommended to choose an old-age cloud mining platform with a long running history;

2, Price and maintenance costs need to have cost-effective; under the premise of the credit and performance capabilities of the platform, the lower the external selling price of the cloud mining contract, the more investment advantage.

At present, after the price of mining machines has fallen to the bottom of the market, the price of some cloud mining products in the market has also bottomed out; recently, the world-renowned cloud mining platform OXBTC (oxbtc.com), it has dropped the contract price to 26.5 US dollars per TH/s, the unit cost even exceeds the direct purchase of a mining machines.

Based on the judgment of the current market conditions and confidence in the cryptocurrency market, mining investment may have entered a new dividend period. In addition to the fixed investment in bitcoin, retail investors are also equipped with a certain amount of cloud mining products. Very valuable investment options!

Monday, July 9, 2018

PandaMiner B3 Pro (8G) vs. PandaMiner B3 Pro (4G), Which One to Choose?

PandaMiner B3 Pro (8G) version is now available on our official website. Compared to the original product (PandaMiner B3 Pro), the memory size has been increased from the original 4G to the existing 8G version. Here I would like to introduce you some difference between PandaMiner B3 Pro (8G) and PandaMiner B3 Pro (4G).

1. Stability

The memory frequency in the graphics card mining is the main factor affecting the computing power. The miners will change the graphics bios to reduce the power consumption and increase the computing power. The general change is to reduce the GPU core frequency & increase the memory frequency, and reduce the power consumption limit. In other words, the impact of the GPU of the mine card is not very large, on the contrary, the memory is working under extreme overclocking. Although there is not much improvement in hashrate compared to the B3 Pro (4G) , the mining stability B3 Pro (8G) will be greatly improved.

2. Price

PandaMiner B3 Pro (4G): $2666 ( PSU and shipping cost included)

PandaMiner B3 Pro (8G): $2699 (PSI and shipping cost included)

3. Link:

PandaMiner B3 Pro (4G): https://pandaminer.com/product/product_detail/30

PandaMiner B3 Pro (8G): https://pandaminer.com/product/product_detail/34

4. Apperance

There are no obvious difference in apperance between two miners.

Except for mining stability, there are actually no obvious difference between PandaMiner B3 Pro (8G) and PandaMiner B3 Pro (4G) in other aspects. Therefore, choose 8G or 4G, it’s depended on your actual needs. Whether you choose 4G or 8G, PandaMiner Team will provide you the same service to ensure you have a great shopping exprience.

For more details, welcome to visit our official websie: https://pandaminer.com/.

Thursday, July 5, 2018

Bitcoin Mining Guide in Bear Market of 2018

Speculation and value investing are not always easily distinguished from each other. “The reasonable value investment usually coexists with speculation in a free market, so the former cannot individually happen. The moderate speculation is helpful for boosting the development of the industry. Users are going to become more and more smart. They will never randomly draw a so-called “giants” to act as big bosses or let them settle accounts as before. In contrast, they will more focus on if the project itself is truly has value. It’s a necessary trip before the market step into mature stage”, says from a project funder in cryptocurrency.

Blockchain is the Major Trend and Mining is the Best Way to Involve in the Process of Blockchain

OXTBC was established in 2014 and the CEO, Weicheng. Guo, thinks that currently security control of cryptocurrency and credible consensus system are the key factors to break the barrier of mainstream recognition of cryptocurrency in this industry. Mining (POW: Proof of Work) is the safest consensus system until now. Besides, the CEO of 8BTC(Biggest Forum in China like bitcointalk in the world), Chang Xia also considers that POW is a mathematical problem, meanwhile, the transaction cannot be reversed and the data cannot be tampered. However, the later becomes an issue of humanity, which means that the transaction can be reversed and the data can rollback.

In Terms of Bitcoin Mining, Its Three Functions as below:

1. Issue new bitcoins. Originally there are 21 million bitcoins are designed and all are created by mining. Mining is a process of record-keeping, done through the use of computer processing power by CPU, ASIC or professional GPU miner. When a block of transactions is generated, miners put it through a process, which apply a complex mathematical formula to the information in the block. During confirming process, miners obtain corresponding rewards according to the proportion of proof of work.

2. Maintain the normal payment function of the currency. The normal transaction of bitcoin is secured by hashrate that also can prevent the second payment. In a nutshell, it can prevent cheating. In other words, the key action of mining is not minting, but maintaining. And the producing bitcoin is just the by-product to reward those who contribute to the maintaining of bitcoin financial system.

3. Ensure the system operate safely by mining. Currently the hashrate of the whole internet has reached to 38.33 EH/s. Numerous hashrate maintain the normal operation of the bitcoin system. Only initiating the 51% attack can destroy bitcoin system. However, such numerous hashrate have already formed an unrivalled position.

Cloud mining is the First Choice of Convenant-lite Mining.

Lots of newcomers have misperceptions for the mining that certain hardware, mining environment and knowledge are necessary to mine. However, mining is becoming easy for the mass now with its development and everybody can be a “miner”.

Even if there are different ways to involve in the mining process, the simplest and direct one is to purchase cloud mining contract. Cloud mining is a behavior that platform deploy a number of miners and the hashrate are averagely segmented, then those hashrate are sold out to users by per unit. In short, it is an optimized mining behavior.

Cloud mining possesses many disadvantages. Users don’t need to select mining rigs or concern the mining sites. The noise produced from mining rigs cannot trouble users any more. Users never worry about how to use and maintain the mining rigs neither. All processes have been simplified to one step that is to buy cloud mining contract only and then you can join in mining.

Besides, the bar for users to involve in cloud mining is low. Either the purchasing process or selling price does provide lots of newcomers a chance to try it.

The most important is that the risk of cloud mining mining for newcomers is lower than trading and it can be regarded as the first choice for the entry of stably investment.

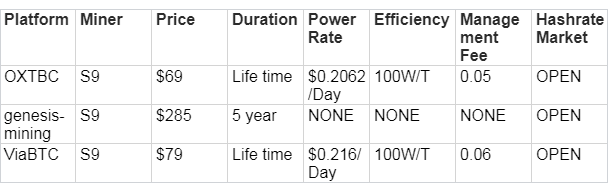

Following are the data comparison among the major mainstream platform:

OXTBC: Top Cloud Mining Platform

Since the early of establishment in 2015, the cloud mining platform at the same period almost failed, sold out or escaped. However, OXTBC not only survives but also still normally operates. Depending on the low electricity fee advantages and the professional large-scaled mining farm, it has been providing stable contract profits for users during these consecutive 3 years.

The managed contracts of cloud mining were firstly created in 2017 to ensure the opening and transparency of issuing the profits of hashrate. Users can sign in the official website to check the profits details of each day anytime. Comparing to other platforms, OXTBC provides the low-barrier purchasing channel and the lowest one of bitcoin cloud mining is 1THS (it means that if a mining rig of S9 is segmented into 14 pieces, then users can contribute to 1/14 hashrate.) The lowest of Ethernet computing power is 1MHS so that everybody can get the chance to join in mining to decrease the centralization trend. Moreover, OXTBC has great advantages on selling price, power rate and management charge and still offer more profits room to users by selling at the lowest rate among the whole platforms.

Tuesday, June 19, 2018

Ethereum Mining, GPU Mining Rig Is Still Strong

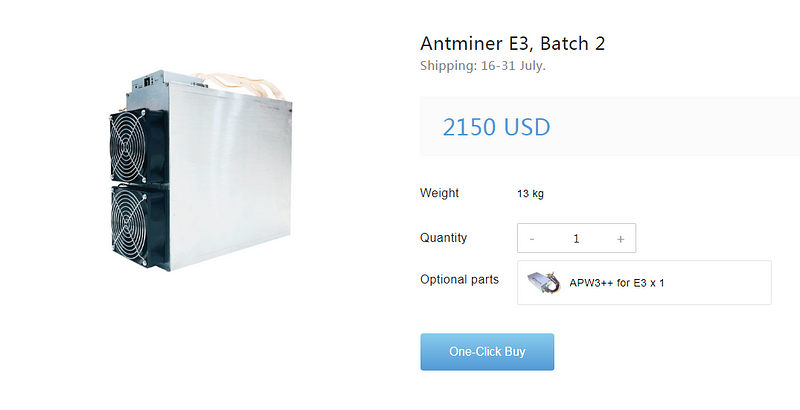

Bitmain released the brand new Antminer E3 in overseas markets — an upgrade of Ethereum miner which is very likely to lead to losses for existing miners. The price of E3 has risen fast since it’s released. The so-called ASIC Ethereum miner failed the high expectation in terms of higher hashrate and less power consumption, and it’s performance is way worse than ASIC miners.

Why doesn’t E3 have obvious advantages? Let’s make a comparison between E3 and PandaMiner B3 Pro, which is currently the most powerful GPU integrated miner in the market. Of course you can put your own graphics card machine in the comparison too:

Cost

As Antminer E3 is an ASIC miner, it is impossible for it to weigh of 13KG. And it is very likely that it’s installed with 6 chips built-in graphics cards. It is worth noting that Antminer E3 for this batch only supports overseas shipping. According to the logistics partner UPS, the minimum shipments cost for one unit is around $150. Plus an official power supply of $105 yuan, the total unit cost will reach as high as $2405, or $13 for each MHS.

While PandaMiner B3 Pro is integrated with AMD RX470 4G graphics cards, and the market price of 8 graphics cards is around $2158. Added with power supply, motherboard, chassis and other parts, the total costs is quite transparent.

ModelRetail PricePower SupplyShipping CostTotal CostHashrateMhs CostAntminer E3$2150$105$150$2405180MHS$13.36/MHSPandaMiner B3 Pro$2508$0$0$2508220MHS$11.4/MHS

By contrast, costs to get an E3 are even higher due to limited supply, and it’s not hard to imagine that miners will choose the most competitive product. Not only the cost of purchase, delivery time is also another important aspect.

Delivery

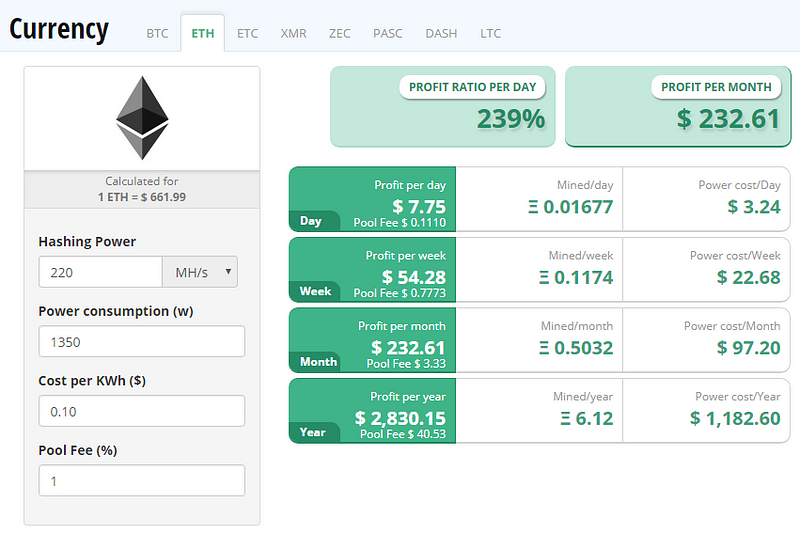

The delivery for B3 only takes 7 working days. However, it is expected to make delivery in July for E3, meaning still 3 months to go. With such a long waiting period, B3 totally will win over E3 in profits. Check the current profit ratio as follows:

And what will happen in three months is clear to everyone — 3 months loss of time and efficiency. Miners don’t want to waste their time which equals to mining profits.

Specifications

Antminer E3 runs 180 MHS hashpower for ETH mining, similar to all miners running 6 graphic cards. PandaMiner B3 Pro runs 220 MHS on the other hand, and the power consumption is basically 1300W. The difference in power consumption is not significant with the same hashrate, so E3 does not have a win either in power consumption.

Scrap Value

Now let’s compare the residual value of both miners. PandaMiner B3 Pro is a GPU integrated miner with a normal display output. The price of second-hand graphics cards in the market is still considerable. While an E3 can maintain after being obsolete as it is ASIC miners designed only for mining.

In summary, GPU mining is still strong and more adaptable to the market, and the price of Antminer E3 is not at all competitive for mining. The majority of miners can continue to stick to GPU mining. Compared with ASIC miners pegged to certain coins, GPU mining is more feasible and can stand the test of the market in the long run. Another major threat to E3 is that Ethereum is able to resist the ASIC miner through hard fork, if ti’s supported by the Ethereum community.

Altcoins mining

GPU miners support a lot of altcoins, as follows. Generally speaking, GPU miner is more flexible and can quickly switch coin types according to profitability. The current higher-yielding coins are ETH, XMR, ZEC and so on, and miners can choose their coin types based on their preference. After all, the cryptocurrency development changes too fast. Perhaps one of the following will become a potential black horse.

AlgorithmsCoinEthashETH//ETC/ELLA/ETP/ETFGroestlGRSX11GostSIBCryptoNightXMR/ETN/XDNEquihashZEC/BTG/BPALyra2REv2XVG/MONANeoScryptFTC/VIVOBlake(14r)DCRPascalPASLNIST5BWKXevanBSDX14HSRX13sm3BCD

About PandaMiner:

PandaMiner is a professional cryptocurrency hardware R&D technology company. With strong technology and R&D strength, PandaMiner stands out in the field of graphics card mining, and successfully produces stable integrated graphic card miners with high performance and low power consumption. PandaMiner has units that make miner R&D, cloud mining, miner hosting, mining pool, almost covers the entire cryptocurrency mining industry chain. Our vision is to perfect our products to meet the demands of the ever-growing mining industry and make mining simple.

For more details, please click official website: https://pandaminer.com/.

Subscribe to:

Comments (Atom)